The Beginner’s Edge A Monthly Digest

This Ain’t No Dip!

“For those properly prepared, the bear market is not only a calamity but an opportunity.” John Templeton

by Alex Cunningham on October 1st, host of Market Adventures Podcast

Welcome to the Market Adventures monthly newsletter! I’m glad you’re here and even more excited that you’ve taken an interest in the stock market. Below you’ll find market information, education, and opinions. I’ve also included affiliate links for various services that I utilize in my investment journey. Feel free to take advantage of the opportunities. If you’re getting this and you bought the stock market 101 course, this is where you put that information to work. You’ve learned the basics, now you see some real life examples.

Please read 👇

“This newsletter and all related Market Adventures content is not investing advice. Everything you are about to read is merely the opinion of the writer. Please seek the counsel of a financial advisor prior to making any investment decisions. Though the stock market does present many opportunities to make money, there are an infinite number of ways to lose all or more than your original investment. That being said. Don’t invest or trade in any security mentioned in this publication or its related content.” Now that that’s out of the way…

China Fumbles The Bag, Again

Evergrande Debt Crisis

China based commercial and residential building giant, Evergrande, has defaulted on several hundred BILLION dollars in debt. You can find more in-depth information on the situation here. But in the most basic terms, they have international investors that may be impacted by their potential fallout. This brings up fears that originally surfaced with the Bill Hwang a few months ago and his firm leveraging into assets with money from several different banks. This brings to question, how many more overleveraged players are there on the global scale?

The issue seemed to be resolved with a report of restructuring of the debt but, then again, there is also some not so supportive news on the subject elsewhere.

Key Terms To Know After September and Moving Forward

Inflation:

“Inflation is the decline of purchasing power of a given currency over time” (investopedia). To keep it simple, the value of money is going down due to oversupply. Remember the rule of supply and demand. When there is more money in the system (economy), each dollar is worth less.

Why is this important for September? The government and the Fed are still pouring money into the system with the Covid relief packages used to stabilize the economy and aid regular citizens like you and me. That money came out of nowhere.

Investors are waiting to find out exactly when that money is going to stop flowing in and how aggressive or how slowly it will be turned off.

If you’re wondering why the stock market has been getting hammered this month, this is a big reason that has resurfaced.

Stagflation:

Stagflation is characterized by slow economic growth and relatively high unemployment—or economic stagnation—which is at the same time accompanied by rising prices (i.e. inflation) (investopedia). Again, to keep it simple, inflation in a market that is no longer expanding or actually contracting. Unemployment remains relatively high (based on the desired result of the money infusion) and inflation continues to rise due to the stimulus.

Why is this important in September? The amount of jobs being filled is slowing, even with much of the unemployment benefits being lifted. If people are not going back to work, for whatever reason, but the money keeps being pumped in, that’s no bueno.

This might be a concern for investors as well because the Federal reserve continues to say unemployment hasn’t met their goal to begin reducing their buying of bonds.

The More You Learn, The More You Earn: Blinkist

Learn Anything in 15 minutes

Perfect for curious people who love to learn, busy people who don’t have time to read, and even people who aren’t into reading. Blinkist takes the key ideas and insights from over 4,000 nonfiction bestsellers in more than 27 categories and gathers them together in 15-minute text and audio explainers that help you understand more about the core ideas.

Feed your brain while: Driving, Commuting, Doing housework, Walking, Relaxing

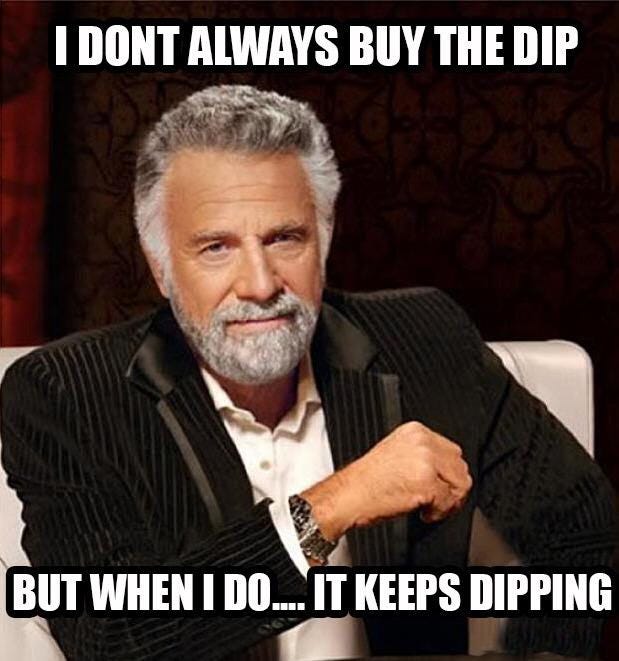

A Technical Look

The Broader Market | S&P 500

This is a 5 year weekly chart of the S&P 500 index (SPY)

Hitting The Ceiling, Fibonacci 0%

“Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. They stem from Fibonacci’s sequence, a mathematical formula that originated in the 13th century” (investopedia).

As you can see on this weekly chart, coincidentally, we hit that 0% line and began falling...and falling hard. Funny enough, all that news came out on the way up and the Fed began to speak as we started falling down.

Technical signals and news are often closely aligned. It’s the chicken and the egg question again. However, having an understanding of technical analysis allows you to be better prepared to take advantage of when these coincidences happen.

Daily Crossing Signs

RSI - crossed below the 50 line

MACD - Beige over blue line and crossed below the zero-line

TTM Squeeze - crossed below the zero-line

FIND A WAY TO

PUT YOUR MONEY TO WORK

Passive Income Using Crypto:

BlockFi (8.6% yield)

I use this to earn monthly interest on my cash. Here, I buy stable coins directly and use this as a savings account. The best part about this account is that when it’s time to get my money out, it’s ready for me in 1-2 business days. Use My Link To Get Free Crypto When You Fund Your BlockFi Account

Celcius Network (8.6% yield)

This is where I keep my crypto. Here I have my Bitcoin, Ethereum and XLM. I buy my crypto using Coinbase and then transfer them to my Celcius account. Here I earn 5-6% WEEKLY on my crypto. That means I’ll be earning each week and my crypto will appreciate in value. That’s a double dip on my way to wealth. Use Code “174345b036” To Get Free Crypto When You Fund Your Celcius Account

Important Economic reports this month: 10/01 ISM manufacturing, personal spending/income, PCE price index | 10/04 factory orders, OPEC meeting | 10/05 services PMI, ISM-non factoring | 10/06 ADP nonfarm employment change | 10/08 unemployment rate, nonfarm payroll | 10/12 JOLTS | 10/13 CORE CPI | 10/14 PPI | 10/15 Retail sales | 10/21 Fed manufacturing

Featured Episode: Cryptocurrency and Stocks, the One Investing Strategy That Works For Both

If you're interested in investing but don't know where to start, this strategy will get you further than you ever imagined...if you'll only be patient. Remember, as you begin searching for answers to life’s challenges, don’t seek security, seek adventure

Listen on Spotify | Listen on Apple Podcasts | Listen on Web

Join The Club Book Of The Month

By now, your mind is beginning to understand how powerful this all really is. When it is put to work, anything is possible. This book, “The Richest Man in Babylon,” will give you an insight into proper money management.

YOU CANNOT BE RICH unless you learn to handle your money.

YOU CANNOT GET MORE if you can’t handle what you already have.

Learn to put away 10% of every penny you earn and don’t touch it. Build your army and then you put them to work. Read this book a few times, it is very short. If you learn the lessons taught in this book, you will be further ahead than 99% of the population.

This Month’s Long-term Stock Pick

ROBINHOOD ($HOOD) Current Price: $42.08 (source: TdAmeritrade)

This is in line with philosophy that you should own what you use. I use this every day. With the development of an actual crypto wallet, they’re going to attract a more committed user base.

Robinhood Markets, Inc. develops financial services platforms. The Company is principally focused on developing applications for cash management such as stocks, exchange-traded funds, options, and cryptocurrency. The Company's platform offers trading in United States (U.S) listed stocks and exchange traded funds (ETFs), as well as related options and American depositary receipts (ADRs); cryptocurrency trading through its subsidiary, Robinhood Crypto, LLC (RHC); fractional trading, which enables its customers to build a diversified portfolio and access stocks; recurring investments; cash management, which includes Robinhood-branded debit cards; Robinhood Gold, a monthly paid subscription service that provides customers with features, such as instant access to deposits and professional research.

Get $200, And Save The Planet: Aspiration

Why do I bank with Aspiration? At Aspiration, my deposits will never go towards funding fossil fuel projects, firearms, or political campaigns. There are no fees for having an account and there is no minimum balance. I can get up to 10% cashback at environmentally friendly partners, access up to 20x the interest of a traditional bank savings account and pay no fees at almost 60 thousand ATMs. When you use the link, you can get up to $200 for opening an account.

My Current Long-Term Holdings:

$T, $WKHS, $AGNC, $VLDR, $XRX, $IRM, $WFC, $MO, $ABBV, $XLE, $PFE, $O, $HBI, $INTC, $KO, $IBM $ARKX $COIN $UBER $AAPL $AMD $ABNB $SKLZ $BFLY $HOOD

My Current Cryptocurrency Holdings: $BTC, $ETH, $XLM $COMP $CGLD $FORTH $NU $GRT $DAI $GUSD

My Current Swing Trade Positions:

Current PAPER trading positions: $TSLA

My Current Options Trading Positions: $HOOD $37/$36 Put Credit Spread Exp 10/15

My Son’s Long-Term Holdings: $DKNG, $EPD, $UBER, $ETH $BTC

My Daughter’s Long-Term Holdings: $ETHE, $AGNC $ETH $BTC

Market Adventures

Miami, FL, 33028