The Beginner’s Edge A Monthly Digest

More Record Highs!

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” John Maynard Keynes

by Alex Cunningham on July 1st, host of Market Adventures Podcast

Welcome to the Market Adventures monthly newsletter! I’m glad you’re here and even more excited that you’ve taken an interest in the stock market. Below you’ll find market information, education, and opinions. I’ve also included affiliate links for various services that I utilize in my investment journey. Feel free to take advantage of the opportunities. Follow & watch me trade live and review stocks.

Please read 👇

“This newsletter and all related Market Adventures content is not investing advice. Everything you are about to read is merely the opinion of the writer. Please seek the counsel of a financial advisor prior to making any investment decisions. Though the stock market does present many opportunities to make money, there are an infinite number of ways to lose all or more than your original investment. That being said. Don’t invest or trade in any security mentioned in this publication or its related content.” Now that that’s out of the way…

Follow The Money

Did You Notice The Rotation?

Investors moved back into tech and out of the defensive stocks. This may be in part to the Feds continued dovish position on the economic recovery. The fear of inflation and sooner than expected Federal interest rate hikes led to the rotation out of tech we saw last month. But the FOMC statements helped dissipate those fears, at least in the short term.

JUNE 2021 Sector Performance

Always Start With

The Broader Market | S&P 500

Price Action Is Superior To Indicators

To start the month, we’re hanging out at all-time highs, seemingly unshaken by any semi-bad news that hits the street. What really slowed the rapid rise was the concern over inflation and the central bank response. Now that-that is past, the market would need something big to shake it out of this slow melt up.

Learn Something New

Dovish: Refers to the tone of language used to describe a situation and the associated implications for actions. For example, if the Federal Reserve bank refers to inflation in a dovish tone (which they did recently), it is unlikely that they would take aggressive actions. Opposite of hawkish. (source: nasdaq.com)

This is why the markets have been so green lately.

PUT YOUR MONEY TO WORK

Passiv Portfolio Management: Passiv

Autopilot for your Portfolio

Passiv turns your brokerage account into a modern portfolio management tool. Build your own personalized index, invest and rebalance with the click of a button, and seamlessly manage multiple accounts.

Dividend Stock Investing: AGNC (8.57% yield)

An internally-managed real estate investment trust (“REIT”). They invest predominantly in agency mortgage-backed securities (“agency MBS”). Great monthly dividend stock. High yield with a healthy dividend history. They are offering $1.25 billion in common stock, which will likely bring down the price of the stock in the short term. However, this company has some good value.

Stocks To Watch | New Trading Strategy

I’ve adopted a new trading strategy. It’s still in BETA, so I DO NOT RECOMMEND TRYING IT (or anything in here for that matter)

Weekly chart: Trading range after a fall, RSI below 50 & coming up, MACD below par & flattening (yellow over blue, getting closer), TTM squeeze 3rd yellow off the bottom

Daily Chart: RSI above 50, MACD pointing up (blue over yellow), Force index flat to rising

Has had a decent amount of success with swing trades. Have not leveraged options using this technique yet.

Conservative Profit Goal: 5% Move In Stock Price per trade (though in certain stocks more return is not uncommon, particularly tech which was very generous last month)

Considerations:

We’re in a Bull market. Let it run unless there is a technical or major fundamental reason to reduce position.

2% loss rule, don’t lose more than 2% of the entire portfolio balance on any one trade

Have a target to take profits. An exit strategy. 3% conserviative, 5% in this market is common.

Wait For the Set Up

Remember, the general market supersedes individual stocks. Even when individual stocks set up to move higher, a general market downturn will weigh on all securities.

Example of new strategy:

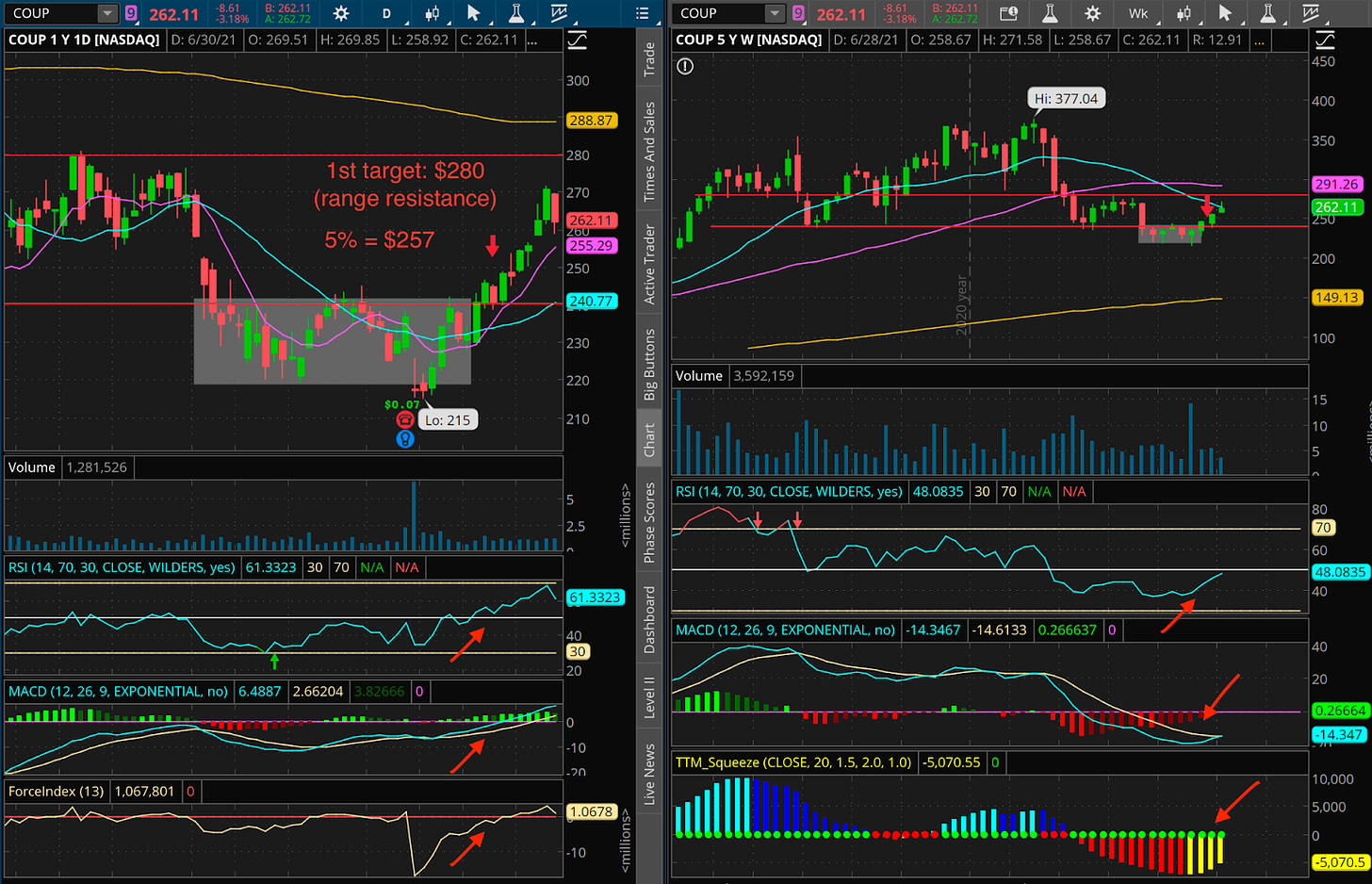

COUPA SOFTWARE INC ($COUP)

Entry price: 243.67 | 1st target $257 (5%) | Top of the range target: $280 (14%)

Weekly at time of purchase (RIGHT): trading range after fall, MACD below par flattening, TTM on 3rd candle after red, RSI below 50 pointing up

Daily at time of purchase (LEFT): RSI above 50, MACD pointing up, Force Index Up

Potential setups

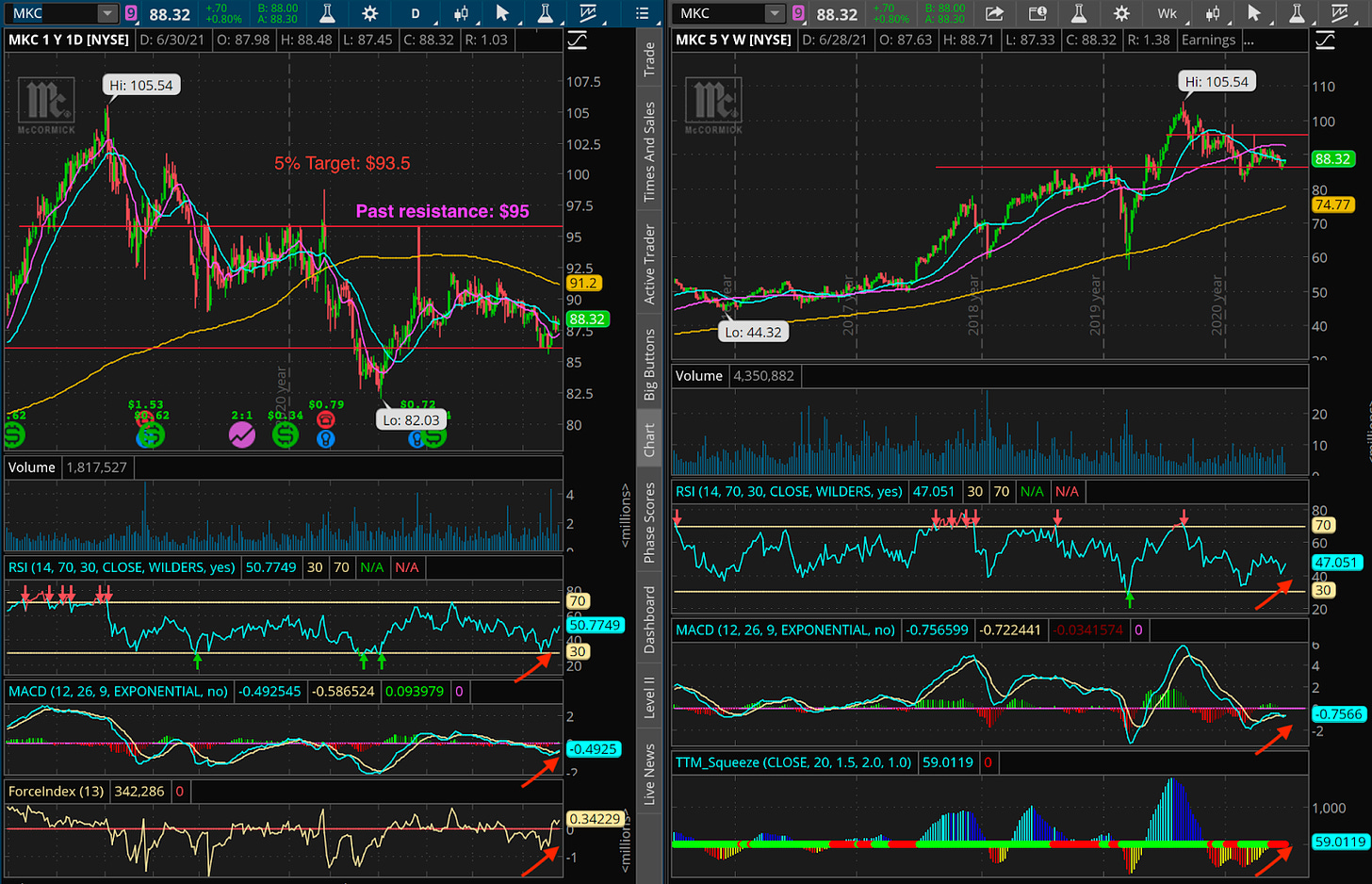

McCormick & Company, Inc ($MKC)

Profit Target $93.5 (5%) | Near-term resistance: $95

Tight range, waking profits immediately at price target. If the technicals fail once I enter the trade, I get out. Period. 2% loss is at $87. If it falls below but remains above support at $86, then I wait for the technicals to give me a signal to get back in. Take the loss, this is a probability game. Nothing is certain.

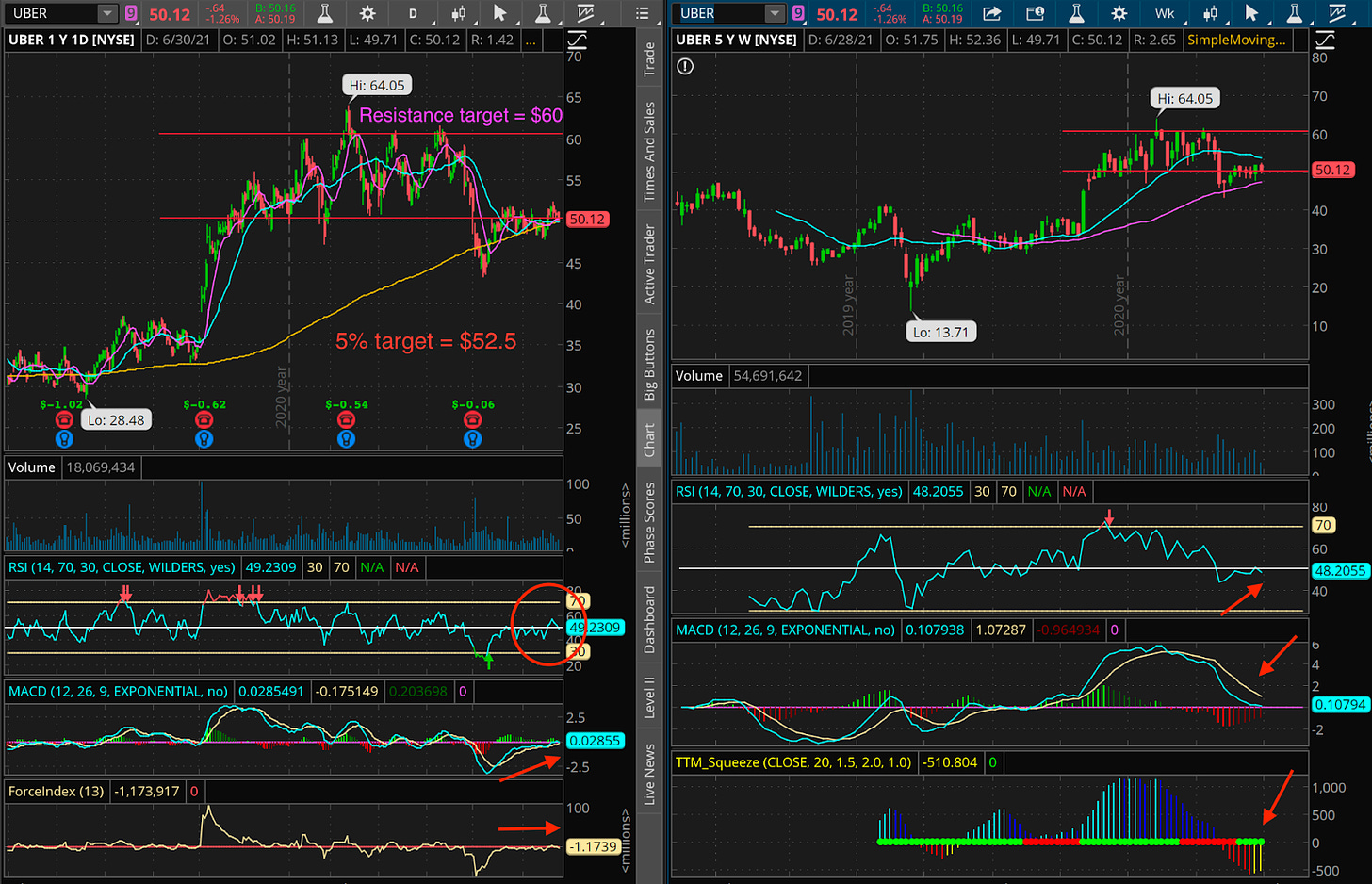

Uber ($Uber)

1st target $52.50 (5%) | Low Analyst avg. price target: $55 (average price: $72) | Top-end target: $60 (20%)

Weekly (RIGHT): RSI below 50 but if it turns down, that breaks criteria

Daily (LEFT): Need RSI on daily to turn back up for entry. Sitting on 3 moving averages (lines on main chart)

Important reports this month: 07/01 ISM manufacturing | 07/02 Jobs report | 07/06 ISM non-manufacturing | 07/13 Core CPI | 07/14 Core PPI | 07/28 FED interest rate decision

Listen To This: Finding Freedom In The Stock Market w/ Chris Hanson (Part 1)

Life changing 4 part series with Chris Hanson, a full-time stock market trader. Chris retired from IBM at the age of 41 after he learned and spent years cultivating his trading system. For the last 15+ years, Chris has lived off of his trades and hasn’t worked since retiring from IBM. In these episodes he teaches us the mindset that he feels encompasses 95% of what it takes to be a successful investor. Go listen to this episode and you won’t want to stop until the series is over.

Listen on Spotify | Listen on Apple Podcasts | Listen on Web

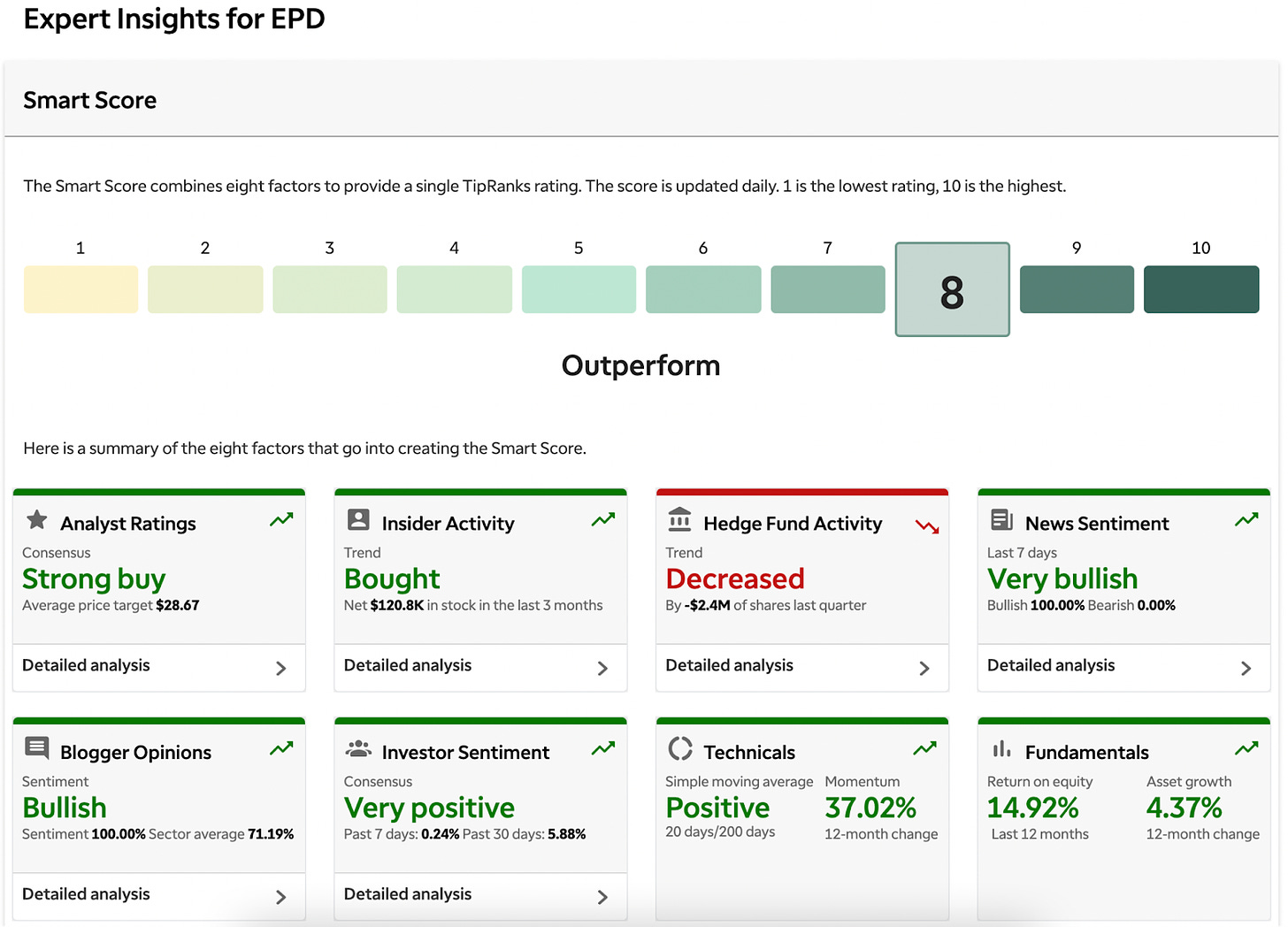

This Month’s Long-term Stock Pick

Enterprise Products Partners L.P ($EPD), 7.44% Dividend Quarterly Yield (source: TdAmeritrade)

Enterprise Products Partners L.P. (Enterprise) is a provider of midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals and refined products in North America.

Consistently one of the most efficient companies in the Oil, Gas & Consumable Fuels industry.

My Current Long-Term Holdings:

$T, $WKHS, $AGNC, $VLDR, $XRX, $IRM, $WFC, $MO, $ABBV, $XLE, $PFE, $O, $HBI, $INTC, $KO, $IBM $ARKX $UBER

My Current Cryptocurrency Holdings: $BTC, $ETH, $XLM $COMP $CGLD $FORTH $NU $GRT $DAI $GUSD

My Current Swing Trade Positions: $COUP $SPOT $TSLA

Current PAPER trading positions: $TDOC, $NFLX, $RAMP, $JPM 08/20 Call $155

My Current Options Trading Positions: TLT $120 Put 7/16, T $30 Call 01/20/23

My Son’s Long-Term Holdings: $DKNG, $EPD, $UBER

My Daughter’s Long-Term Holdings: $ETHE, $AGNC

Market Adventures

Miami, FL, 33169